amazon flex driver tax forms

FREE Shipping on orders over 25 shipped by Amazon. Driving for Amazon flex can be a good way to earn supplemental income.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Have a valid US.

. Please retain a copy of all tax information you provide to Amazon. The main tax form you need to file is Schedule C. The Borough of Roselle NJ.

Does Amazon flex report to IRS. Actual earnings will depend on your location any tips you receive how long it. Box 740 Freehold NJ 07728 Satellite Office 190 Christopher Columbus Drive Suite 2A Jersey City NJ 07302 TOLL FREE IN NJ.

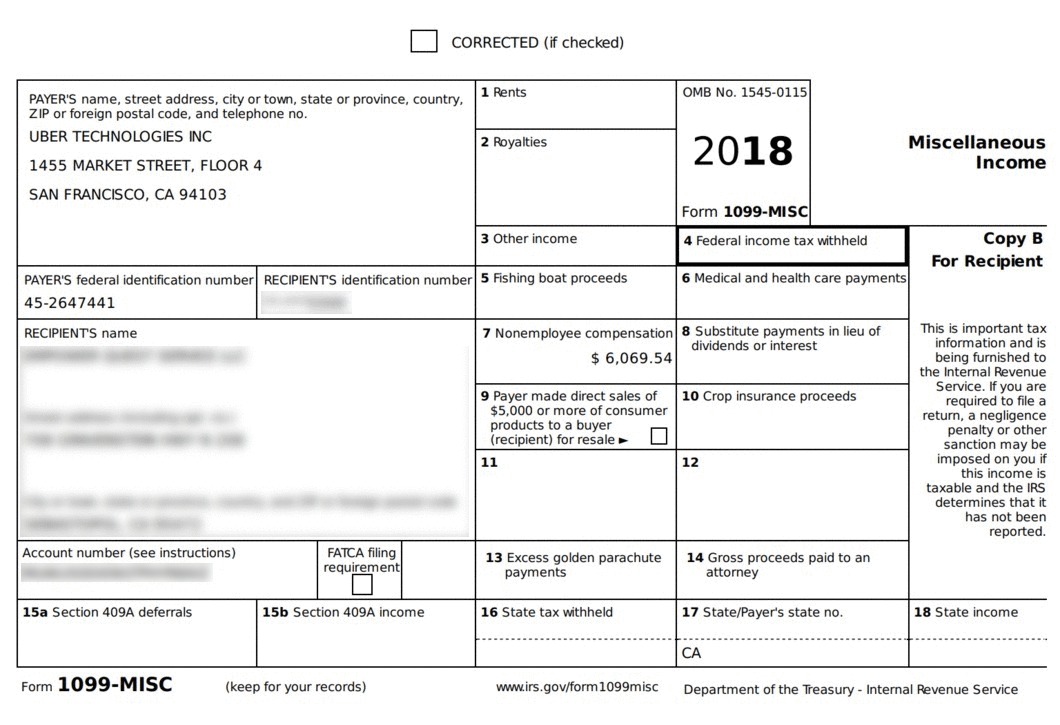

Tap Forgot password and follow the instructions to receive assistance. Increase Your Earnings. 1099 Forms Youll Receive As An Amazon Flex Driver.

Schedule C is part of a Form 1040 individual tax. Select Sign in with Amazon. Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers.

Have a mid-size or larger vehicle. 1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC. If you participate in Amazon Flex or have participated in a similar program you can request a copy of your 1099 from Amazon.

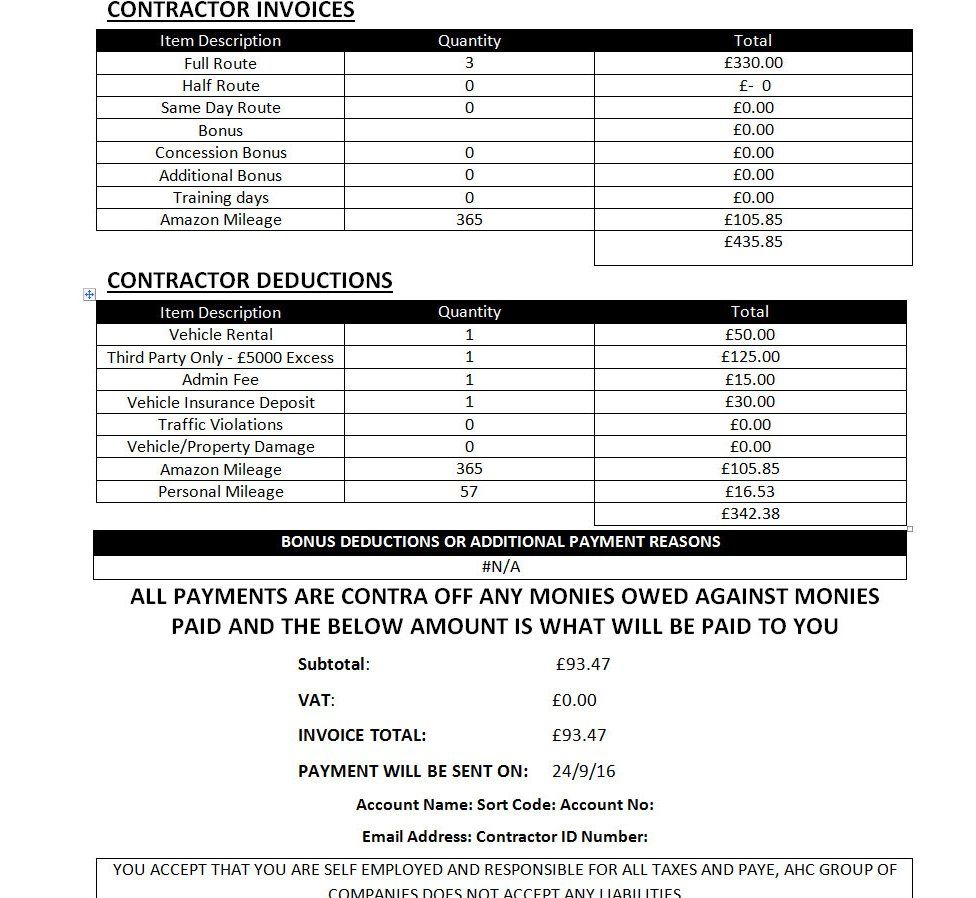

12 tax write-offs for Amazon Flex drivers. Click Download to download copies of the desired forms. Blue Summit Supplies W-3C Wage Correction Tax Forms 2022 10 Form W-3 C Laser Transmittal of Corrected Wage and Tax Statements W3 C Forms Compatible with QuickBooks and Accounting Software 10 Pack.

This is where you enter your delivery income and business deductions. When you are a self-employed delivery driver you are issued a 1099 form. Knowing your tax write-offs can be a good way to keep that income in.

Most drivers earn 18-25 an hour. Or download the Amazon Flex app. Gig Economy Masters Course.

Get it as soon as Mon Oct 10. A 1099 form is a series of documents the IRS calls an information return defined as a tax return that contains taxpayers identifying. 2 Paragon Way Suite 400B PO.

You can ask Amazon for your 1099. To be eligible you must. No matter what your goal is Amazon Flex helps you get there.

Coastal Title Agency Inc. Click ViewEdit and then click Find Forms. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906.

Be 21 or older. Sign in using the email and password associated with your account.

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Drivers Work Illegal Hours Bbc News

How To File Amazon Flex 1099 Taxes The Easy Way

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex Taxes Documents Checklists Essentials

Amazon Enters Gig Economy With Uber For Packages Service Amazon The Guardian

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Tax For Self Employed Amazon Flex Drivers Goselfemployed Co

How To Become An Amazon Flex Driver Hyrecar

Tax Forms Email R Amazonflexdrivers